property tax loans florida

Miami-Dade County collects the. The property tax sale process for properties with unpaid taxes is handled according to Florida law so it works the same way in every Florida county.

Real Estate Blog Mortgage Payment Property Tax Florida Real Estate

Provide information to prove the amount on the warrant is not due.

. You provide some brief background info. CALL 561-810-1711 OR CLICK HERE TO GET STARTED. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000.

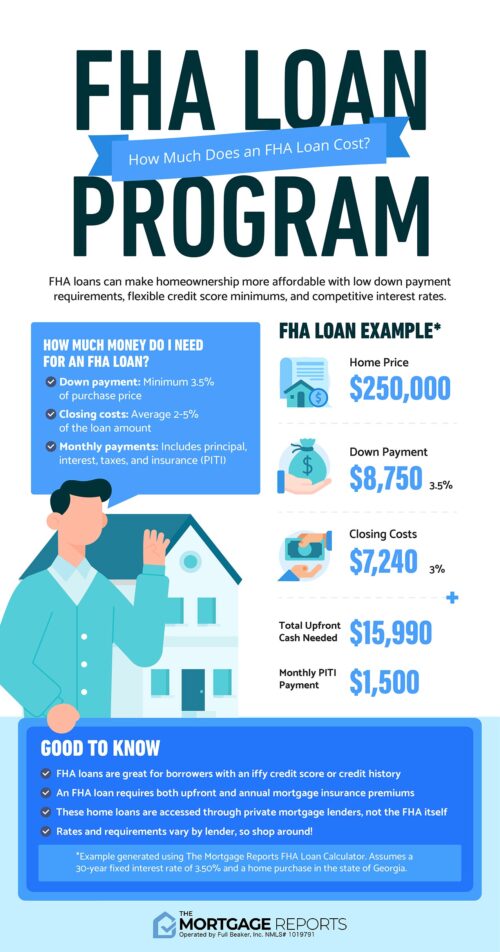

Also there is often more flexibility relative to the down payment with Florida. This includes a new roof new kitchen appliances and so on. Another property tax exemption available in Florida and the rest of the country is the one you can get by deducting the amount you pay in mortgage interest from your overall taxable income.

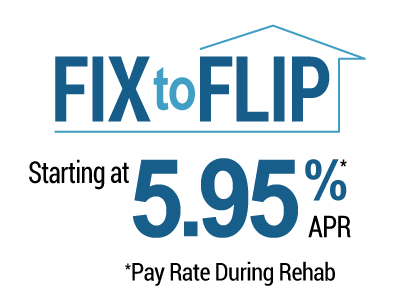

These include interest only balloon payments fixed-rate amortization and more. Then you sign the documents with our online notaries or with our mobile notaries. Interest rates can either change in accordance with fluctuations in the national rate or they can remain fixed.

Both you and your lender should receive a notice from your local tax authority. Pick your loan amount online or with our licensed loan officers. This can get confusing so heres an example.

6650 Professional Pkwy STE 102 Sarasota FL 34240. You also dont have to pay for solar lease maintenance. That means if your Florida solar system saves you 400 a year your home.

FLORIDA PROPERTY TAX LOANS. Enter a stipulated payment agreement. Second youll need to have a sound credit history.

Its easy to pay off your property taxes when you call Tax Ease. Mortgage Interest Property Tax Deductions. Many experts claim that for every 1 reduced in annual utility bills a propertys value increases 20.

We know land weve been financing it for over a century. Weve helped thousands of Texans save time and money with Texas property tax loans. The exact property tax levied depends on the county in Florida the property is located in.

In all Florida counties except Miami-Dade the tax rate imposed on documents subject to tax is 70 cents on each 100 or portion thereof of the total consideration. Flexible terms and payment schedules. It all starts when you dont pay your property tax bill on time.

7500 from the property value if 30 to 49 disabled. When your property taxes are due to the county your lender uses the funds in that escrow account to pay the taxes on your behalf. Documentary Stamp and Intangible Tax exempt.

How Much Do Solar Panels Boost Property Value. Funding takes place after a post-closing review and the expiration of a 3 business. The additional 25000 exemption is available for non-school taxes and applies only to the assessed value between 50000 and 75000.

For example your 2019 property taxes are due by March 31 2020. It frees the first 25000 of the homes assessed value from all property taxes and it exempts another 25000 from non-school property taxes. Lets say you have a home with an assessed value of 80000.

If youre looking to add to your property or if you have your eye on a piece of land to build a home on we can help finance your purchase. The amount is as follows. The process is simple.

To resolve your tax liability you must do one of the following. Florida is ranked 18th of the 50 states for property taxes as a percentage of median income. Pay the amount in full.

The first 25000 in property value is exempt from all property taxes including school district taxes. Like the mortgage insurance deduction this one comes with limits. Competitive Rates- fixed and variable.

Ad Unlock The Wealth In Your Home. No maximum acreage limitations. Floridas median income is 53595 per year so the median yearly property tax paid by Florida residents amounts to approximately of their yearly income.

The first 25000 would be exempt from all property taxes. The State of Florida has disabled Veteran property tax benefits including exemptions that compliment the VA Mortgage programs disabled Veteran funding fee. Read the Departments tax collection process to learn more about what taxpayers can do to avoid becoming delinquent.

Best of all with our no money out of pocket solar loans you can start saving immediately. Property taxes in Florida are due on March 31st of the following year. Section 201021a Florida Statutes FS.

Income will be consistent between the Internal Revenue Code and the Florida Income Tax Code. We generate documents in as little as 30 minutes. Florida owner financing also allows for a variety of payment options.

If you dont its best to contact your lender and your tax authority to make sure your property taxes are being paid on time. If its a trailer or a mobile home you have to have a county property tax lien on the property to show you are up to date on the payments. The exemption depends on the disability rating.

5000 from the property value if 10 to 29 disabled. Under the Florida Constitution every Florida homeowner can receive a homestead exemption up to 50000. 10000 from the property value if 50 to 69 disabled.

12000 from the property value if 70 to 100 disabled. First off your investment property needs to be already paid for. With three base locations in Dallas Houston and McAllen TX we provide hassle-free Texas property tax loans for residential or commercial property owners.

Florida Usda Home Loans 1st Florida Mortgage

Fha Loan Calculator Check Your Fha Mortgage Payment

Methods Of Land Ownership Free Of Property Tax

Property Taxes By State In 2022 A Complete Rundown

Your Guide To Prorated Taxes In A Real Estate Transaction

What Is A Homestead Exemption And How Does It Work Lendingtree

Va Lending And Property Tax Exemptions For Veterans Homeowners

How Do Tax Deed Sales In Florida Work Dewitt Law Firm

Property Tax How To Calculate Local Considerations

How To Get A Florida Fha Loan First Time Home Buyers Guide

The Risks Of Purchasing A Florida Property In A Tax Sale Business Law Real Estate Immigration Litigation Probate 305 921 0440

How To Lower Property Taxes 7 Tips Quicken Loans

Florida Home Loans 1st Florida Mortgage

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Is It A Good Idea To Prepay Property Taxes Embrace Home Loans

Property Taxes By State In 2022 A Complete Rundown

Florida Property Tax H R Block